Ethereum is switching into a proof-of-stake consensus to allow the network to achieve scalability. Ethereum staking is when people lock up Ether (ETH) for a given time. The ETH is staked on the blockchain to boost the network’s security while generating rewards.

What is Ethereum 2.0?

Ethereum 2.0, also known as Serenity, is a usable, scalable and sustainable solution for users on the Ethereum blockchain. The current Ethereum network is plagued with many issues, such as high transaction costs. Sometimes, the fee for a single transaction on Ethereum can reach $200.

Ethereum 2.0, also known as Serenity, is a usable, scalable and sustainable solution for users on the Ethereum blockchain.

The network also suffers from slow transaction speeds, where the number of processed transactions per second (TPS) ranges from between 10 and 15. This is very low compared to Visa, whose TPS stands at 17,000. The current Ethereum network also runs on a proof-of-work consensus that is energy-intensive.

Ethereum 2.0 seeks to end these concerns by lowering the transaction fees on Ethereum and boosting the TPS. Ethereum 2.0 will make it easier for decentralized finance (DeFi) applications to be developed and run on the Ethereum blockchain.

Proof-of-Stake (PoS) vs Proof-of-Work (PoW)

The current Ethereum blockchain operates on a proof-of-work (PoW) consensus. PoW is where a new block is generated when the network participants use computational resources and energy. PoW is very energy-intensive, and it is also used by the Bitcoin network.

On the other hand, proof-of-stake (PoS) is where the network participants stake cryptocurrencies as collateral to generate new blocks. The staked tokens are used as security to guarantee that the users will generate valid blocks. If invalid blocks are generated, an amount of staked tokens is deducted.

There are major advantages of the PoS consensus compared to the PoW consensus. The first is that PoS removes the need to invest in powerful computing equipment that consumes high amounts of energy. Moreover, PoS is believed to be more scalable compared to PoW.

How does staking Ethereum work?

Staking Ethereum is done to boost the decentralization of the Ethereum blockchain. Like the other PoS blockchains, Ethereum 2.0 allows users to stake funds on the blockchain to generate passive income and help the network.

The earned rewards are known as annual percentage yields (APYs). Investors who stake on the network will receive a reward. The staking rewards generated on the network will depend upon the amount that the investor has staked and the number of validators on the blockchain.

Benefits of staking Ethereum

There is a wide range of benefits that come from staking Ethereum. Ethereum is the second-largest cryptocurrency by market capitalization, and it is also the most-utilized network by decentralized finance (DeFi) protocols. Therefore, any investment opportunities on the network attract many investors.

Below are the benefits gained from staking Ethereum:

- Generate passive income. Those who stake Ethereum earn a passive income through the annual percentage yield. The more ETH you stake on the network, the higher the rewards will be.

- It is easy to stake ETH. It is also easy to stake Ethereum even for smaller investors. A retail investor can stake Ethereum through cryptocurrency exchange platforms or a wide range of applications.

Drawbacks of staking Ethereum?

While staking Ethereum allows you to help the network as you generate rewards, potential drawbacks arise from this activity. Therefore, before staking, ensure you do proper research to weigh the benefits and risks. The drawbacks of staking Ethereum include the following:

- The value of Ethereum 2.0. The value of Ethereum 2.0 is currently not known. ETH 2.0 will be a cryptocurrency, and it will be susceptible to the volatility of the crypto market. Therefore, you should stake when you are confident about the project’s success that could contribute to major gains for ETH 2.0.

- You cannot liquidate. The other drawback of staking Ethereum is the lack of liquidation. As an investor, you cannot withdraw your earned Ethereum or even the staked Ethereum until after the launch of Ethereum 2.0. The launch is expected to happen in two years. Therefore, if you are a short-term investor, staking Ethereum might not be a good fit. If you are planning to hold Ethereum over the next five years, then staking could be good for you because it allows you to benefit from a possible price gain, and you also have the chance to generate rewards. You should note that it is also possible to stake Ethereum through an exchange. Doing this will increase liquidity as you can withdraw your funds. However, if you stake Ether on exchanges, you are not supporting the Ethereum network.

- Risk of bugs. Ethereum is currently one of the most secure and reliable blockchain networks. However, there is still a potential for bugs that could be exploited and result in losses for those who had staked on the network. Nevertheless, the Ethereum community is large, and many investors are running validator nodes. There are also many developers working on the Ethereum network, and there have been very few instances of bugs on the network. However, there is still a chance that bugs will be detected.

Is it a good idea to stake Ethereum?

The main reason people want to stake Ethereum is the potential for gains. The annual percentage yield generated from staking ranges between 6% and 15%. The amount that one can stake on the network is 32 ETH, which brings the rewards between 2 and 5 ETH over the course of a year.

The duration of time that you have to stake your ETH can deter many investors. If you do not have 32 ETH to spare for the next two years, staking might not be ideal for you. You will not access the staked ETH or the rewards until Ethereum 2.0 is released.

Additionally, there are alternative ways of staking Ethereum, such as through exchanges. This is preferred for an investor that wants to realize short-term benefits and enjoys the convenience of liquidity.

Staking Ether is an ideal investment strategy for people interested in helping the network. If you want to validate the network, help it and generate rewards, then staking Ether could be a perfect fit for you.

What are the ways to stake Ethereum?

Anyone can stake Ethereum and be part of the community committed to boosting the growth of the network and promoting decentralization. Moreover, staking is like a long-term investment strategy into the Ethereum network. If you want to stake Ether, below are the different ways to do this:

Staking Pools

To purchase a validator node, you need 32 ETH, which is equivalent to more than $92,800 at the current prices. This is a large amount for a single person to pledge to a network for over two years.

Staking pools bring small investors together, allowing them to contribute a small amount that will raise what is needed to run a validator node. The rewards generated will depend upon the amount that the pool managed to raise.

The rewards generated through staking pools are distributed among the contributors. However, the company behind the staking pool deducts a commission that can be very high. Sometimes, the commission can be as high as 25% of the staking rewards.

Moreover, Ethereum staking pools are custodial in nature, and as an investor, you will not gain direct access to your crypto wallet or Ether. Your contribution will be piled together with that of others in the pool.

Staking ETH on your PC

It is possible to stake Ethereum on your PC as Ethereum 2.0 uses cloud servers. When you stake ETH on your personal computer, you will enjoy 100% of the generated rewards, unlike a staking pool.

However, there are risks arising from staking ETH on your PC. The first is that your server should never miss an attestation provided by a Beacon Chain. In case of power cuts, slow internet connections or software issues, you might miss this.

Additionally, you should also have the technical know-how if you want to run a validator and beacon node on your PC. You start the process by choosing an ETH2 client. The choice of a client can be determined by performance and consistency.

Tokenized staking

Tokenized staking is provided by cryptocurrency exchange platforms and companies that manage staking pools. Tokenized staking is provided by some of the largest centralized exchanges in the crypto market.

Tokenized staking might be easier to access for a beginner, but it is not the best option for an individual or institutional investors. Through tokenized staking, ETH is converted into a synthetic token and then pooled together with contributions from others.

The rewards are also distributed among the contributors through the synthetic token. This increases the risk of volatility. Moreover, tokenized staking is also centralized, and it is not deemed a perfect fit for those who want to stake more than 32 ETH.

Virtual server staking

The other option of staking ETH is through virtual server staking (VSS). This is a non-custodial solution that offers major benefits compared to tokenized staking. The process of virtual server staking is straightforward. However, there can be technicalities involved if the VSS lags behind.

Moreover, VSS providers are also not big on promoting infrastructure quality. The development teams might not fully focus on Ethereum staking, running updates on the network, providing technical support and boosting flexibility.

While the risks with virtual server staking are high, it remains a top option for an investor staking small amounts of Ethereum. The onboarding and setup process is quite easy for an investor with a small amount of Ether and lacks the technical know-how.

Non-custodial

The most lucrative way to stake ETH is going the noncustodial way. This method gets rid of third-party fees, allowing you to earn more. Non-custodial and independent Ethereum 2.0 staking is made possible by Launchnodes.

Launch Nodes is currently the only non-custodial Ethereum 2.0 staking validator in the crypto space. It allows an investor to stake through Amazon Web Services (AWS). Using AWS ensures continuous uptime while lowering the risk of missed attestations.

Through non-custodial staking, there are fewer intermediaries involved, and you have full control when running a validator node. You will enjoy 100% of the earned rewards. Non-custodial Ethereum staking is popular with individual and institutional investors globally.

Staking ETH2 directly is an ideal solution when an individual or institution wants to run multiple nodes. You will save all your profits while enjoying zero third-party fees.

How to stake Ethereum on AMSTERDAX

AMSTERDAX is a multi-award winning platform that allows you to stake Ethereum and a wide range of other cryptocurrencies into DeFi yield-generating projects rather than through Ethereum protocol itself. If you want to stake ETH on AMSTERDAX in order to generate passive income on your coins, follow the below steps:

Step 1: Open a staking position

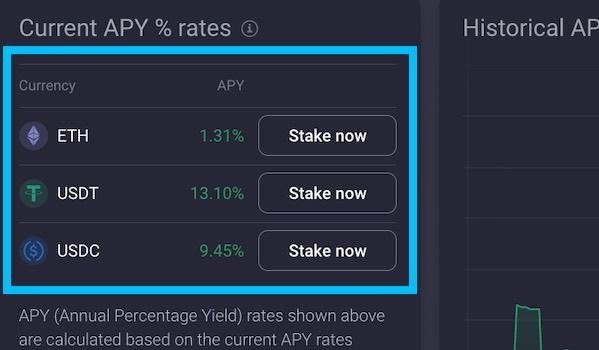

To start staking Ethereum on AMSTERDAX, go to the Yield Rates page, select the cryptocurrency that you want to stake and select “Stake now.” In this case, you will choose to stake Ethereum. You need to have Ether in your account to start staking.

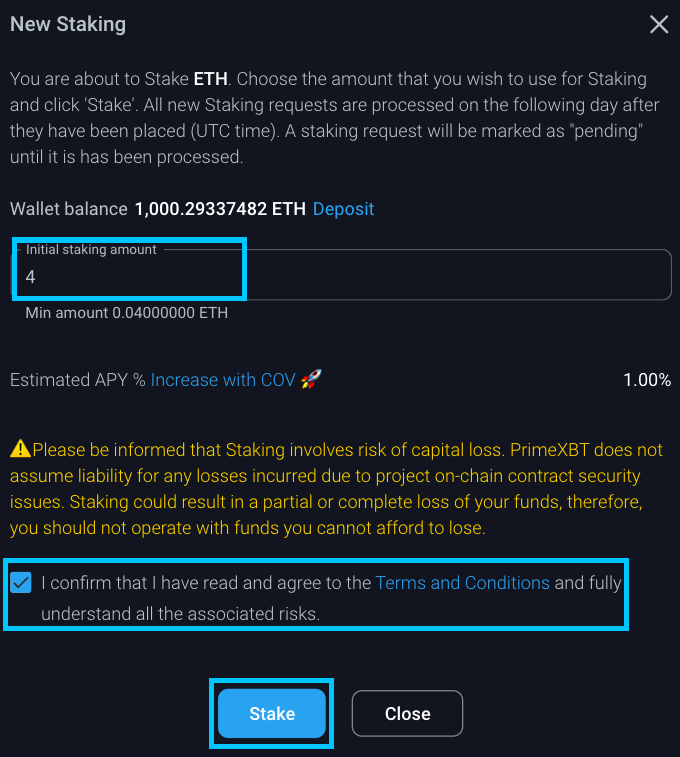

Step 2: Choose the amount you want to stake

The next step is to choose the amount that you want to stake. The minimum amount that you can stake is 0.04 ETH. Once you have entered the amount, confirm that you agree to the terms and conditions, and then select “stake”.

Step 3: Wait for your stake request to be approved

Once you have selected “Stake”, the request will remain pending and it will be approved at 00:00 UTC. New staking requests are processed only once each day at 00:00 UTC. Note that once you have opened a new staking position, you cannot cancel.

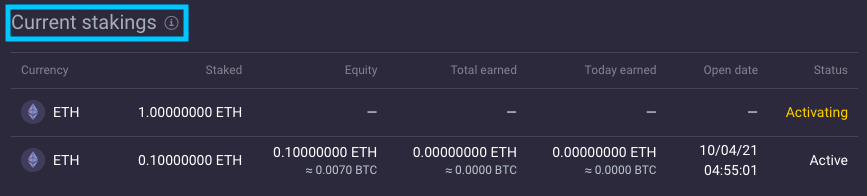

You can view the status of your stakings, whether active or pending, on the “Current stakings” section on the “My Accounts” page as shown below:

When you click on a staking, it will display a stats page that will show you detailed information about your position including the APY and Equity charts. On the stats page, you can also close a staking.

What are the rewards for staking Ethereum?

The rewards of staking Ethereum comes from the generated APY. The reward generated depends on the number of staked ETH tokens and the number of validators in the network.

When there is less ETH staked on the network, the interest rate will increase. However, the more ETH there is locked into the network, the lower the interest rate will be. Whether the interest rate will be high or low, the generated annual rewards will not be withdrawn until Ethereum 2.0 goes live.

The rewards for staking Ethereum are also determined by the strategy taken by the investor. If the investor chooses to use a staking pool, the reward earned will be significantly low compared to using strategies such as non-custodial staking.

Why stake Ethereum with AMSTERDAX

There are many benefits realized from staking Ethereum with AMSTERDAX. These benefits include:

- User friendliness. AMSTERDAX offers a user-friendly interface. Traders that do not have any technical know-how can start staking Ethereum on the platform. You can start earning interest on your crypto on AMSTERDAX through a few steps.

- Be in control. When you stake Ethereum with AMSTERDAX, you will be in control of your crypto. You can withdraw your staked assets and interest at any time. This solves one of the great hindrances there are to staking.

- Competitive APY. At AMSTERDAX, you will also enjoy a competitive annual percentage yield (APY) on your staked crypto. This APY will increase or decrease depending on factors such as demand, supply, volatility, etc.

Conclusion

The Ethereum network has significantly grown over the years despite facing issues of high gas fees and slow transaction speeds. Currently, Ethereum is the king of DeFi, and it commands a giant share of the DeFi TVL.

Ethereum 2.0 seeks to make the Ethereum network an even better alternative for DeFi, and this means that the network has more potential for gains. Staking Ethereum has attracted global interest from both individual and institutional investors.

Currently, a large amount of ETH is staked on the Ethereum 2.0 deposit contract. The fact that none of this ETH will be accessed until Ethereum 2.0 goes live shows that investors are willing to bet on the long-term success of the Ethereum network.

Moreover, the Ethereum blockchain network has a committed team of developers. These developers work round the clock to enable the network to achieve a high sense of security and adoption. This boosts investor confidence that funds are safe on the network.

Is there a staking minimum and maximum?

If you want to become a network validator, you need 32 ETH to create a validator node. However, through AMSTERDAX staking service, you can stake any amount of Ether.

Can you lose money staking Ethereum?

It is possible to lose money staking Ethereum. This can happen during slashing, where you will be penalized if there is a validator failure.

Is staking Ethereum safe?

Staking Ethereum can be risky, as network failure or bugs are possible. Therefore, before staking, assess the pros and cons.

Is staking Ethereum profitable?

Staking Ethereum is profitable for the long-term because you will earn an annual percentage yield on the staked amount. However, you will only enjoy the profits after Ethereum 2.0 goes live.