Trading the EUR/USD pair is rather common in the Forex world, so before you trade anything else in the currency markets, you need to understand this pair, as it is not only the biggest market in the Forex world, but it is also a great indicator on how the US dollar is trading. In fact, some people use the EUR/USD as a gauge for risk appetite around the world.

The History of EUR/USD

Interestingly, despite the dominance in trading volume and popularity, the EUR/USD instrument is only around 20 years old, while most other fiat currencies have been around for a century or more.

On January 1, 1999, the Euro was born. The Euro was first viewed as a potential contender to the dollar. A physical Euro was later introduced in 2002, and Euro/Dollar trading started soon thereafter in the Forex market.

Initially used in 12 economies, seven other countries have switched over to using the Euro since the initial launch. The Euro initially fell to an exchange rate of $0.8296 on October 26, 2001, and even fell as low as $0.8115 on January 15, 2002. However, the Euro recovered from its early slump and reached parity in November 2002.

The Euro has peaked at $1.5916 on July 14, 2008. However, the Great Financial Crisis had a major negative influence on the currency, as traders ditched the Euro for treasuries in the United States.

Despite early volatility, the Euro has stabilized to become the second most important currency in the world, with some people even calling for the Euro to become the world’s reserve currency. The last several years have seen some countries call for the Euro to be used to buy and sell oil and other commodities, although the vast majority of transactions still happen in US dollars.

What influences EUR/USD?

There are several factors that can have a dramatic impact on the EUR to the USD exchange rate. These factors include political factors, environmental issues such as natural disasters, and even pandemics like the Coronavirus that can seriously shake up markets.

The strength of Europe’s economy versus the United States can also potentially impact the exchange rate of the EUR to USD currency pair. Here are more details regarding the role of each major currency to better understand their potential impact on the global economy and what that might mean for price action.

It is worth also noting that the interest rate differential is a major influence on what happens in this currency pair, and many traders will keep an eye on the 10-year note in the United States versus the 10-year note in Germany. As the yield rises in one country or another, trading capital will tend to flow towards the higher rate. While other 10 year yields in the European Union might offer more return, the reality is that Germany makes up roughly 80% of the volume.

Role of the Euro

The Euro is the currency of 19 of the 27 member states of the European Union. This group of nations is referred to as the “eurozone” and is home to more than 300 million people.

It is also the second-largest and second-most traded currency in the foreign exchange market after the United States dollar. Each euro is divided into one hundred cents.

The Euro is also the second most widely held global reserve currency behind the dollar. It represents the economic health of all of the nations within the eurozone.

The Role of USD

The United States dollar is the current global reserve currency and is the base currency on which all major exchange rates are set. It affords the United States a power position in terms of its economy and has allowed the country to act as the center of finance globally.

Because the dollar is so important to global trade it by far has the largest trading volume and its impact on other markets cannot be overstated. It also is the currency that most commodities are traded in around the world, including gold, wheat, crude oil, and many others.

What Are the Advantages of EUR/USD Trading?

The advantages are trading the EUR/USD pair are numerous, which makes sense considering that it is the most widely traded Forex pair in the world and one of the biggest markets in the world for that matter.

- Extremely liquid – The EUR/USD pair is one of the most widely traded markets in the world and is most certainly the largest amount of currency exchange in the world, so therefore it is extremely liquid. This means that you can get in and out of your trades easily and that the spread is very small.

- 24-hour availability – Although most Forex pairs are available 24 hours a day, there are some that are limited in their trading hours. Furthermore, some are open 24 hours a day but are a lot less liquid at certain times. This is not an issue with the EUR/USD pair.

- Widely available information – The information that influences the value of this currency pair is widely available, as the world’s largest economies are represented by the currencies.

- Long-term trend – This pair tends to have multiyear trends that are relatively easy to follow, and spot. This is by far one of the biggest advantages to trading the EUR/USD pair.

What Are the Risks of EUR/USD Trading?

While trading the EUR/USD pair is quite common for Forex traders to do, there are some risks that come with the market, just like any other financial instrument.

- Volatility – Volatility can swing quite wildly in the Forex markets, and that is going to be the same in this currency pair. However, it should be noted that this pair more often than not suffers from a lack of volatility, making it more steady than other pairs, which may work against your trading style.

- Geopolitical events – One of the specifics about the Euro that is different than many other currencies is that there are so many countries that use the currency. Because of this, a geopolitical event or even simple politics in a country like Germany, Spain, or Italy can cause a lot of noisy trading.

- Commodity noise – This is more due to the US dollar than the Euro, as commodity markets are almost always priced in US dollars. If the commodity markets get out of kilter, it can have an influence on this pair.

- Risk-on/risk-off – Be aware that the US dollar is considered to be a “safety currency”, so if there is a sudden rush to safety due to economic or political events, quite often the Euro is a victim of the US dollar strength. This may or may not have anything to do with the Euro itself.

How to trade EUR/USD

The following information is designed to give you an overview of how to get started trading the Euro against the US dollar. The pair is quite often the first place that currency traders “cut their teeth in the market”, and therefore is a highly popular choice for developing strategies.

The pair is one of the most liquid markets in the world, meaning that you can get in and out of your position rather easily. It also can be traded around the clock, which of course helps those who have to work a day job.

The overview expressed in this guide can be used in both bullish and bearish markets, and these guide rails should be thought of as a starting point for new traders to begin their journey. The individual strategy and types of trading are explored, but it is up to the individual trader to figure out which way is right for them. There is no “one size fits all” type of answer, but these are the things that you need to think about in order to become successful.

EUR/USD Trading Styles

There are more ways than one to trade the Euro Dollar effectively depending on personal tastes and the time available to put into the market. That being said, in general, trading can be broken down into three different styles.

One of the most important things that traders often overlook is psychology. For example, it is quite common for somebody who is comfortable trading one of the styles to be completely uncomfortable trading the other. It will come down to your personal psychology, and it is something that you should pay close attention to.

If you are to choose a style, pay close attention to how you feel about the trade. If you are comfortable in that type of environment, then it is the right style for you. However, if you find yourself overly concerned about the trade, then you may want to reevaluate how you are choosing to approach the market. In fact, listening to your own psychology is one of the most important things you can do as a trader.

Scalping

Scalping involves getting in and out of positions very quickly, and in fast succession. Scalpers will quite often trade in one direction, only to turn around and trade in the opposite direction rather quickly. They are looking for quick and small gains, but over time, if a scalper is good they can see their profits add up rather significantly.

Intraday Trading

Intraday trading strategies focus on setups that are opened and closed in a single trading session. Quite often, they pay close attention to the daily chart in order to get the overall direction of the market, and then look for setups on lower time frames, closing their positions at the end of their trading day.

Swing Trading

Swing traders spend much longer time in their positions than scalpers or day traders, as they are trying to take advantage of trend changes. These positions can last days, weeks, or even months. They are less concerned about the noise on short-term charts, and more concerned about riding a move as far as they can.

Should be noted that it takes a significant amount of patience to be a swing trader, but for those who have limited time to devote to the markets, swing trading can be a very profitable way to trade. This is because you are not worried about what happens in the market while you were away at work, for example. You are placing a trade based upon where you think the markets will go over the next several days or weeks.

It is also worth asking yourself if you are comfortable holding a position overnight. Some traders are, some traders or not. If you are not, then swing trading is going to be almost impossible. However, if you have the ability to place the trade and walk away, swing trading might be your forte.

EUR/USD Trading Strategies

if you plan on trading the EUR/USD currency pair, you need to develop a strategy to take advantage of the moves in the marketplace. While there is no “one-size-fits-all” type of strategy, the reality is that most strategies can be categorized into a few general types.

These are meant as a starting point, and not a comprehensive guide to strategies. As you read these strategies, think about whether or not it fits with how you view the markets. If one of them does resonate with you, then you know how to go about developing your own system.

Pullback Trading

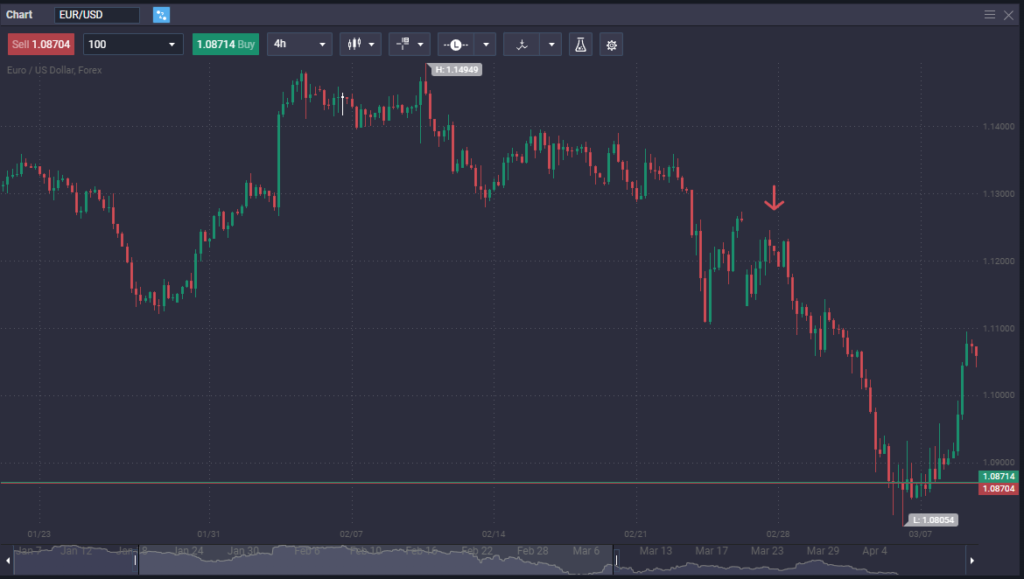

Trading pullbacks is a common strategy that traders will use to trade not only the EUR/USD market but any market that tends to trend for long periods of time. The idea is that the market does not go in one direction forever, and occasionally will have a pullback against the overall trend. This can be observed in both uptrends and downtrends.

When the market pulls back against the trend and then shows signs of exhaustion, traders will quite often enter the market in favor of the original longer-term trend. The pullback is quite often a simple matter of traders in the longer-term trend taking profits and offering those who have been patient enough to wait for the pullback a chance to join the longer-term trade.

There are multiple ways of identifying an entry, which can come down to a Fibonacci retracement level, a previous support or resistance level, or even simple candlestick patterns.

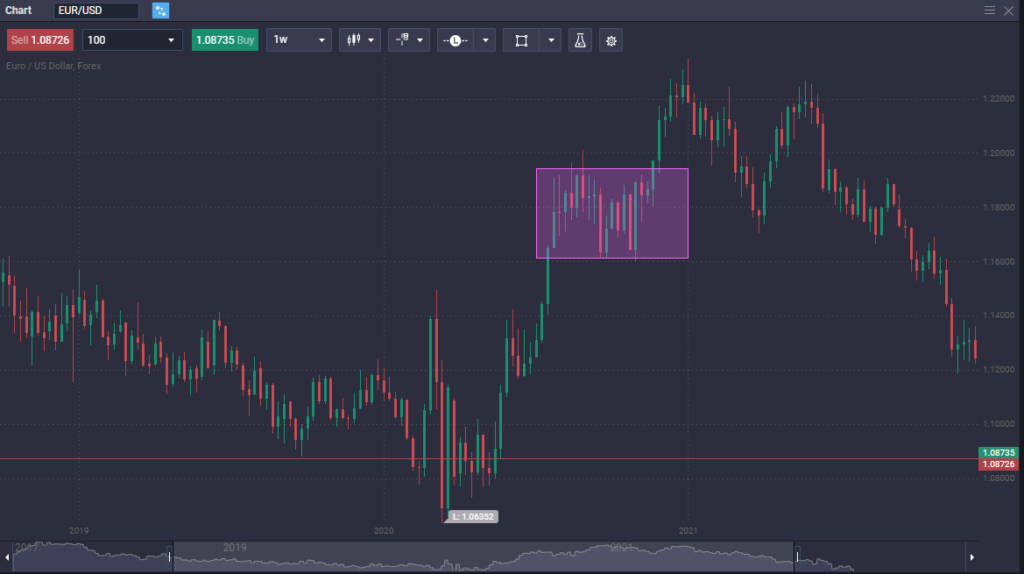

Breakout Trading

One of the most common ways to trade a currency or any other market for that matter is breakout trading. The trader looks at the market and identifies an area of consolidation, where the price is going back and forth in a relatively well-defined pattern.

Understanding that markets consolidate from time to time in the backdrop of longer-term trends, a trader can look at these areas as an opportunity to take advantage of inertia building up in the market. The trading plan is quite simple: Traders are waiting to see the market leave the area, and then jump on board as soon as momentum.

The idea is that traders that have been on the opposite side of the trade will have to cover their positions, thereby pushing the market in your direction. It takes an incredible amount of patience, but it can be quite a profitable way to trade the market. Furthermore, it should be noted that this can be done in any timeframe. That being said, a breakout on a weekly chart carries a lot more weight than a breakout on a five-minute chart.

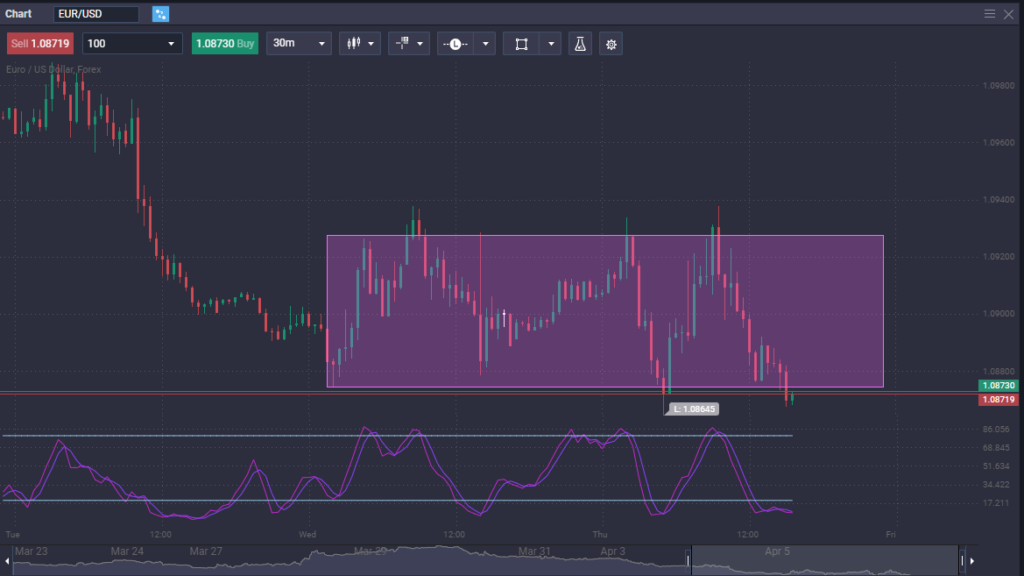

Range bound trading

Some traders prefer to wait until the market is going back and forth in a relatively tight and range-bound area. In this scenario, the idea is to go back and forth with the market until it eventually breaks out of this well-defined area. The idea is that you are trading back and forth and taking advantage of the consolidation until you eventually are proven wrong.

If you do choose to trade like this, you have to accept the fact that sooner or later you will get stopped out. However, if you get a good consolidation area, you may win three or four trades before finally having a losing one. The idea is that you will win more than you lose. It is also common for people to use an oscillator to identify range-bound trading.

Tips for EUR/USD Trading

There are multiple factors to consider when trading the EUR/USD pair. While it is one of the most liquid pairs in the world, there are some nuances that you need to be aware of.

- Test your system – Make sure to test your system in the EUR/USD pair, either through a demo account or historical data to make sure that it has a positive expectancy.

- Listen to Federal Reserve – You need to pay special attention to the Federal Reserve and its announcements, as well as speeches made by members, as they set monetary policy for the United States.

- Listen to the ECB – You also need to pay special attention to the European Central Bank and its announcements, as well as speeches made by members, as they set monetary policy for the European Union.

- Watch interest rate differential – Watch the interest rate differential between major European economies and the United States, by monitoring the 10-year bond markets for the various economies, with a special eye on the German 10-year yield.

Conclusion

Trading the EUR/USD is a great place for beginning traders to learn how to navigate the currency markets. This is because the spread in this pair is typically very tight, so it allows traders to get used to trading in the currency market without having to overcome huge gaps between entry and profitability. Furthermore, it is the most liquid currency pair in the world, so it allows for trading at any time of the day.

It is also worth noting that the two currencies are the two biggest in the world, so therefore financial information and analysis are easy to find online. The Euro is considered to be the “anti-dollar”, therefore if one currency is going fairly well in the world of Forex, the other one typically suffers.

Most traders start trading the EUR/USD before other pairs, as it does tend to move predictably over the longer term. That being said, it operates like any other market in the sense that the analysis is the same, but as it is such a highly traded market, it takes much longer for the trend to change, thereby making it a great place to trade.

What time can I trade EUR/USD?

As the Forex markets are open 24 hours a day, you can trade any time between Monday and Friday. The market opens up during New Zealand time Monday morning and closes during New York time Friday afternoon.

Is EUR/USD a good pair?

The EUR/USD pair is a good pair because it moves in a liquid manner. This means that there are plenty of traders out there involved, so it is easy to get in and out of a position. Furthermore, it typically has the tightest spreads available.

What is the best time to trade EUR/USD?

The best time to trade the EUR/USD pair is the overlap between regular business hours in Europe and early-morning business hours in the United States. That being said, the pair is liquid enough that you can trade it anytime you choose. Even in the quietest times of the trading day, it is possible to get a good spread on the EUR/USD pair.

How do you analyze EUR/USD?

You analyze the EUR/USD pair the same as any other market, by a combination of technical analysis, trend analysis, and any pertinent fundamental analysis or information that is available. You should think of the Euro as the “anti-dollar”, as if the US dollar is soft, it generally means that there is a strengthening Euro, and vice versa.