The Williams Alligator is a technical analysis indicator developed by the late, iconic forex trader Bill Williams, who has given the indicator his namesake. He was also responsible for developing a number of other leading indicators commonly used today, such as the Awesome Oscillator, Williams Fractal, and the Accelerator/Decelerator Oscillator.

Williams Alligator Definition

Williams Alligator is a trend-following indicator that creator Bill Williams compared to an animal being fed, and features specific moving averages called the Alligator’s Jaw, Alligator’s Teeth, and Alligator’s Lips. Technical indicators like the Williams Alligator can make the difference between a losing and winning trading strategy when used in combination with chart patterns and other oscillators and signals.

Why The Williams Alligator Matters

The indicator’s creator, Bill Williams was an early pioneer in financial market psychology and developed some of the most widely used technical indicators today. The Williams Alligator technical analysis indicator can be used to discover the absence of a trend, trends that are beginning to form, and when markets have begun to trend. Traders can utilize this information to make decisions on when to enter or exit the market.

How the Williams Alligator Works

The Williams Alligator is based on the theory that financial assets trend between 15 and 30 percent of the time, while stuck in a tight trading range the other 85 and 70 percent of the time, Williams believed that the former is when most institutional traders book most of their profits. In addition, the moving averages that make up the Alligator indicator can often act as dynamic support or resistance, and can be used as a by or sell signal depending on which way the lines cross, or if candlesticks close above or below the indicator lines.

How the Williams Alligator is Calculated

The Williams Alligator technical analysis indicator is calculated using the following calculations and formula:

SUM1 = SUM (CLOSE, N)

SMMA1 = SUM1/N

Subsequent Values:

PREVSUM = SMMA(i-1) *N

SMMA(i) = (PREVSUM-SMMA(i-1)+CLOSE(i))/N

Glossary:

SUM1 = sum of price closes during N period

N = smoothing period

SMMA1 = smoothed moving average of the first bar

PREVSUM – smoothed sum of the previous bar

SMMA(i) = smoothed moving average of current bar

CLOSE(i) = current price close

Due to the complexity of the calculation, more advanced trading software is necessary to take advantage of the indicator. This tool is one of the many indicators on trading platforms like AMSTERDAX that offer built-in charting tools.

How to Read the Williams Alligator

The Williams Alligator is composed of three lines, the Jaw, a blue line based on the 13-bar SMMA, smoothed by eight bars on subsequent values; the Teeth, a red line based on the eight-bar SMMA, smoothed by five bars on subsequent values; and Lips, a green line based on the five-bar SMMA, smoothed by three bars on subsequent values. Depending on which way these move, cross, or act as support or resistance, can provide traders with valuable signals to take action from.

How to Use the Williams Alligator

The indicator gives signals when the three lines – Jaw, Teeth, and Lips – converge and diverge. The Jaw is the line that turns the slowest, while the Lips turn and cross the fastest, signaling a change in trend.

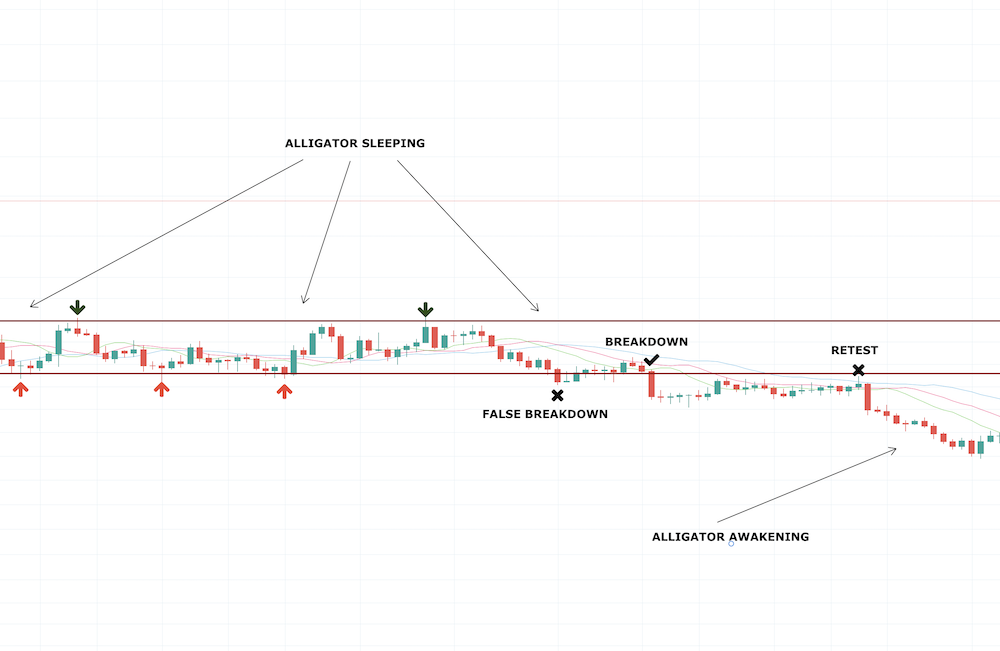

Williams often compared features of the indicator to animals, he referred to a cross of down signaling a short position as the alligator sleeping, while a long trade and cross upward would be considered the alligator awakening. When the three lines diverge widely, a trend is strong showing that the alligator mouth is being fed or is feasting, according to Williams.

However, when the three lines begin to narrow and converge, it indicates that a trend is weakening and may soon reverse, or that a powerful move is near. Traders will then want to watch for a cross of the green and blue lines or a close of a candlestick through the indicator lines before taking action.

The Best Williams Alligator Trading Strategy

Because the Williams Indicator technical analysis indicator is used to understand both when long or short positions should be opened or closed, as well as signal when trends are forming, or slowing and growing in strength, it can be part of an effective trading strategy. Here are some of the most common and effective Wiliams Alligator trading strategies.

Identify When Markets Are About to Trend

The Williams Alligator is a trend-following indicator and can signal the absence of a trend, the formation of a new trend, and the direction of the trend. The alligator is said to be “sleeping” when the lines are tight within a narrow trading range. This is considered an absence of a trend. But once the lines begin to diverge, the alligator is said to be awakening and a new trend forming, and then feasting as it follows the price action as it trends in a new direction.

Range Scalping Using the Williams Alligator

When the alligator is sleeping, it suggests an absence of a trend, causing the asset to trade within a tight trading range. However, this doesn’t mean an eager trader cannot take a position. A scalping strategy buying and selling the support and resistance within the range can be extremely effective. The range is considered broken and a trend forming once a few consecutive candles close outside of the range and the alligator begins to feast again.

Trading Pullbacks To Alligator Support or Resistance

When markets begin to trend, traders can look for pullbacks the Williams Alligator lines to take a position, setting a stop below the support level as a point of invalidation. In the following example, the red line or alligator teeth acts as support at two pullbacks. The third pullback trade was invalidated after the price failed to find support at the lips, teeth, or jaw once again, and broke below previous pullback support.

Swing Trading Alligator Line Crossovers

The most common, effective, and straightforward way to use the Williams Alligator technical analysis indicator is to trade crossovers of the lips and jaw of the alligator. When the green line crosses below the blue, it’s a bearish sell signal, and when the blue line crosses above the green line, it’s a bullish buy signal. This strategy is less risky than other methods, but can often leave some profit on the table by playing it safe.

Candlestick Cross and Close For Catching Trends Early

For traders seeking to find an earlier entry than watching for crossovers of the green and blue lines, they can watch for a price candle to break through all three of the alligator lines, signaling a breakout. Once the candle closes above or below the three lines on the indicator, it signals to traders a buy or sell position should be taken. Oftentimes, these trade signals appear before a crossover to the alligator lines, allowing traders to catch trends earlier. Traders can then exit the trade at a crossover of the green and blue lines, as the alligator begins to sleep, or if a reversal candle closes below the three lines once again, signaling a trend change.

Discovering Dynamic Support or Resistance

Traders often make the mistake of assuming that support or resistance is horizontal only and often can miss out on winning trades as a result. By using the Williams Alligator technical analysis indicator, traders can find levels of dynamic support and resistance, that travels along with price, and is indicated by either of the Alligator’s three lines: the lips, teeth, and jaw.

Tips for Traders And Common Mistakes

Traders can get caught up in market chop using the Williams Alligator. The technical indicator’s creator says that during that type of price action, the alligator is still sleeping and hasn’t yet awakened, suggesting that traders wait for other confirmation or for the price to reflect the trend change signaled by the indicator.

Traders should try to visualize a mouth opening during price rises or declines, which slowly closes once again when volatility dwindles, indicating a potential trend change ahead due to the current trend weakening.

Traders can adjust the settings of the indicator for unique results. Try it yourself!

Conclusion

Williams Alligator is a complex, but extremely helpful and profitable technical analysis indicator, designed by one of the most legendary forex traders to ever live. The indicator can be used across forex, commodities, stock indices, and cryptocurrencies – among the many financial assets offered on AMSTERDAX.

Trading software can be expensive, but AMSTERDAX features built-in charting tools right within the trading dashboard, offering incredible value for traders. Registration is free, minimum deposits are small, fast, and in less than 60 seconds you can sign up for a AMSTERDAX trading account and get started day trading and performing technical analysis using powerful tools like the Williams Alligator.

Applying tools such as the Williams Alligator, stop-loss protection, and up to 1000x leverage on AMSTERDAX allows traders to grow their profits quickly, safely, and using very little starting capital. Try day trading today and sign up for a free AMSTERDAX account.