By trading the CAC 40, you are making a bet on the French economy, and its overall health. Trading this index is an easy way to get exposure to France, and all of the opportunities with its major companies. The index is widely traded and therefore is very liquid.

What is the CAC 40?

The CAC 40 is one of the biggest stock market indices on the European continent, as it follows 40 of the largest companies in France. While the CAC 40 is almost exclusively French companies, the fact that so many other companies are multinational makes it attractive to foreign investors as well.

The index includes some of the most famous French names such as Sanofi, BNP Paribas SA, Société Générale, and Total SA. In this index, you will find a dynamic and wide field of companies represented.

The CAC 40 Companies

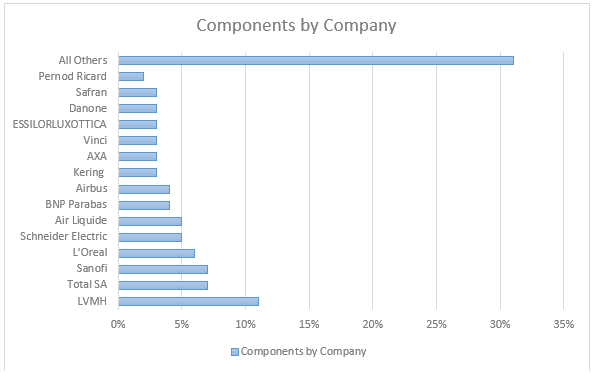

The CAC 40 consists of 40 different French companies. The index features some of the largest French companies such as oil giant Total, BNP Paribas, and LVMH (Louis Vuitton). Underneath is a breakdown of the weighting of each company as of late 2021.

Keep in mind that the companies that make up the index do change from time to time and are reviewed every quarter. The purpose is to review the index to ensure weighting is properly represented and accurately reflects the overall market.

CAC 40 trading hours

The CAC 40 trades between 8 AM and 4:30 PM UTC, which is when the Parisian exchange is open. However, at AMSTERDAX, we offer CFD markets that trade around the clock, thereby making it a much more opportune market to deal with.

Another major benefit to trading at AMSTERDAX via CFDs is that you have the ability to react around-the-clock, and therefore do not get surprised by the way the market opens up the next day. The last thing a trader wants to see is a gap in the opposite direction of their position at the open because it leaves the trader in a position where there are instantaneous losses.

By being able to trade around the clock, you can react to news in real-time, and therefore do not get hit hard at the Paris open. This gives you the ability to protect your account and grow it much easier than via traditional outlets.

How Is CAC 40 Calculated?

The CAC 40 is calculated on a price return basis. The value of the index is based upon the current numbers of shares included in the index of each company multiplied by the last closing price and subsequently divided by a proprietary index divisor. The divisor is based upon the initial capitalization base of the index and the base level, making it dynamic.

By using a dynamic divisor, the market moves in real-time, and also is not “equal-weighted.” In other words, there are some companies that make up much more momentum than others.

What Drives the CAC 40’s price?

To profit from the CAC 40, you need to understand some of the various fundamental factors that will drive prices higher or lower. By paying attention to some of these bigger issues, you can increase your probability of success in the French market. While the market can be influenced by other things, these are the biggest and most common factors.

Monetary policy and economic data

Monetary policy has a major influence on stock market performance, and the CAC 40 will not be an exception. The European Central Bank is responsible for monetary policy around the European Union, although there is a central bank in France. As the French use the Euro as their currency, ECB monetary policy is crucial.

As a general rule, the more accommodative the monetary policy is from the ECB, the higher stock markets tend to move. This will be the same in France as it is in the United States, United Kingdom, or anywhere else. The latest statements coming from ECB members should also be closely followed, as expectations on monetary policy will have a major effect on the market.

Economic data has a major influence as well, especially inflation numbers, as they can have massive implications as to what the monetary policy is going to be. There are also other numbers to pay attention to such as employment and GDP, as they can give you an idea of how the French economy is performing.

Individual corporate influence

As the CAC 40 has 40 separate companies, some will have a bigger influence on the price of the index than others. Pay attention to the largest companies, and what they have to say about the economic health of their particular situation. You should also be aware of earnings statements or news conferences involving these companies because a handful of these companies can make the market move quite significantly in the short term.

Make sure that you know the individual weighting of the various companies in the CAC 40, as it will prioritize the companies that you should be paying attention to, as the market is not “equal-weighted.”

Sociological and political risks

When trading any stock market, you should know that not all risks involve specific economic numbers or profit statements. After all, companies do not operate in a vacuum, so it does make a certain amount of sense that you have to pay attention to the “real world.” A perfect example would be the coronavirus pandemic and its effect on corporate profits.

It is also worth noting that France can sometimes have unrest, as there had been a major trucking strike in the past, as well as farmers going on strike. Both of those had a negative effect on the local economy.

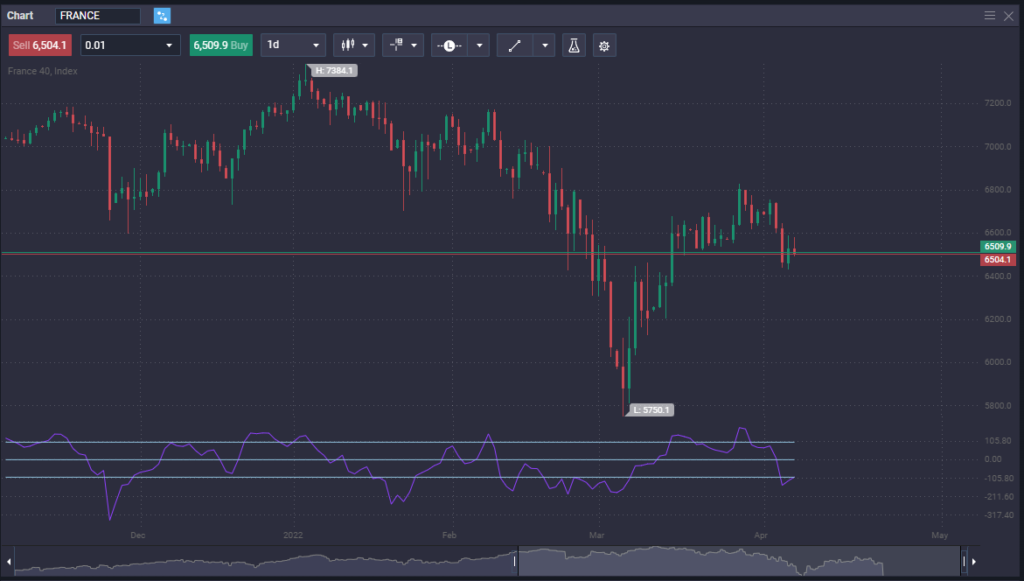

There are also political risks from time to time, and that can cause concerns. For example, the presidential election in France consists of two rounds, with the first one seeing and elimination of all contestants with the exception of the top two. The second round features a runoff election between the two candidates that receive the most votes.

In 2022, there has been a lot of uncertainty surrounding the French presidential election, as Marine Le Pen and Emmanuel Macron are seen as being “neck and neck” in polls. Because of this, the policy of the French government is in question going forward.

What Are the Benefits of CAC 40 trading?

There are plenty of benefits to trading the CAC 40 at AMSTERDAX. The ability to both go long and short of the CAC 40 offers significant opportunities for the prudent trader to take advantage of, including:

- Trade the French economy – By training the CAC 40, you are trading the overall health and strength of the French economy. If you believe that the French economy is strong, you would anticipate that the CAC 40 goes higher. Ultimately, if you see issues in the French economy, you would anticipate that the CAC 40 goes lower.

- Liquid market – The CAC 40 is one of the biggest indices in the world and is traded by both foreign and domestic traders quite heavily. If you are trading the CFD market, you can trade easily at any time.

- Instant diversification – By going long or short the CAC 40, you are diversifying your holdings, as it is based upon 40 separate companies, instead of a single stock.

- Hedge your existing positions – The index can be bought or sold the hedge the risk that you might have in an existing stock portfolio. If you believe that your stocks may face some turbulence, shorting the CAC 40 is a way to protect your overall downside.

What Are the Drawbacks of CAC 40 trading?

Although trading the CAC 40 is a great index, you should know that some issues can come with the territory. Some of the things that you should pay attention to include:

- Centralized risk – You are trading the French index, and by extension the French economy. Because of this, you need to be aware of any nuances that could come along and affect the economy of that country.

- ECB – France, and the rest of the European Union for that matter, are in a unique situation in so much as although they all have their own national central banks, it is the ECB that sets monetary policy. Because of this, you must pay attention to announcements and statements from that authority.

- Leverage risks – When you trade the CAC 40 CFD, you are trading a levered product, and therefore you have to be careful about any risk that you are taking. Keep in mind you need to pay close attention to risk management and understand the inherent dangers of leveraged markets.

- Euro – The French economy uses a currency that is controlled by an external central bank, and therefore monetary policy decisions are not only made by what is going on in France, but also by other countries such as Germany, Italy, and Belgium. Luckily, AMSTERDAX allows Forex trading, and therefore you can monitor the Euro easily.

How to trade CAC 40

If you are going to trade the CAC 40, you need to understand that you have several options available. By understanding all of the different instruments, you will understand that not all investments will be right for your situation. There are significant differences between the available markets.

CAC 40 CFDs

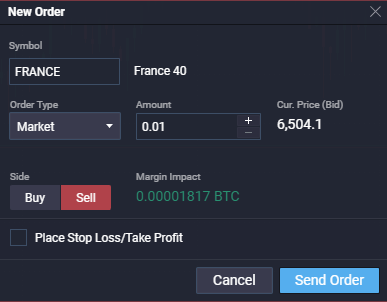

The CAC 40 can be traded through the CFD market, which is an abbreviation of “contract for difference.” These contracts are derivatives of the underlying index and are easy to trade. By buying or selling the CFD, the trader is entering an agreement to settle the difference between the opening and closing price by cash settlement.

This simplifies the entire investing process because the trader does not have to worry about financing, borrowing a star, or coming up with an exorbitant amount of margin. The CFD market also allows for precise position sizing, making it ideal for retail traders.

CAC 40 futures

You can also trade CAC 40 futures, which are a derivative of the index. They are traded on a regulated exchange and have standardized contract sizes. However, the futures market requires a large amount of margin, so therefore futures markets are not necessarily viable for retail traders. It comes down to your amount of trading capital, and whether or not futures trading is a possibility.

More often than not, longer-term traders will use futures markets to hedge existing stock positions. For example, if you have a large exposure to French equities, you may choose to short the futures contract to mitigate overall losses.

CAC 40 options

CAC 40 options are available to be traded, which gives you the right, but not the obligation, to buy or sell the index at a set price on a future date. However, most traders will settle the difference in cash, and not necessarily take on the futures position. Options are much cheaper than trading futures but do have a fixed contract size, so it is difficult to customize the size of the position.

Options have an expiration date, which makes them change value over the course of time. If the index is nowhere near the “strike price” and time is running out, the option starts to lose value rapidly. Because of this, you need to be cautious about when you enter an options contract, and of course how far from the strike price you are when you get involved.

Some traders “write options”, which is essentially selling the option contract to other traders. However, this can be an extraordinarily dangerous proposition, as your losses can, at least in theory, be limitless.

CAC 40 stocks and ETFs

Some traders choose to trade the index by purchasing individual stocks or ETFs. The exchange-traded fund is probably the simplest way to take advantage of moves in the CAC 40 when it comes to a traditional brokerage. It is simply an instrument that owns a basket of stocks, in the same type of proportion that you would get by owning the entire index.

Buying individual stocks will bring its own issues, with both complications and expense being at the top of the list. Another thing to worry about when it comes to trading an ETF or a list of individual stocks is that they only trade at certain times of the day.

Tips for CAC 40 Trading

The CAC 40 might be a great index to trade, but like anything else, it has a certain amount of factors that you need to pay close attention to. While this list is not everything that traders need to concentrate on, it does give you an idea of some of the biggest issues that you need to address before trading real money.

- Build a trading plan – Make sure that you have a trading plan that works with the CAC 40. You can test it against historical data or use a demo account to determine whether or not your plan works in this market.

- Earnings announcements – Understand that some companies having an earnings announcement might have more of an effect on the index. You need to keep these announcements front and center, understanding the effects of those announcements on the market.

- News – You need to keep an eye on news coming out of France, and the European Union in general.

- Understand the risks of leverage – Leverage is something that you need to use responsibly, as it can cause irreparable damage to your trading account.

- Currency fluctuations – As many of the largest components and France are somewhat luxury-based, you need to watch how the Euro is performing, as a strong Euro can influence the affordability of these products around the world. AMSTERDAX offers the Euro, so it is easy to keep track of how it is performing.

Why Trade CAC 40 With AMSTERDAX

Trading the CAC 40 with AMSTERDAX is a great way to get exposure to the European economy, as the index follows so many major companies. The CAC 40 is a market that allows the trader to simplify the entire process of trading in the EU, offering opportunities both long and short.

- CFD market – AMSTERDAX offers the CFD for CAC 40, meaning that you can trade in smaller positions if necessary. Trading CFD contracts allow you to customize your position size, thereby offering better risk management opportunities.

- Leverage – Prime XBT offers 1:100 leverage on the CAC 40, allowing traders to increase profits with smaller accounts. For the profitable trader, this leads to explosive growth.

- Crypto deposits – AMSTERDAX accepts crypto deposits and offers the ability to use your crypto to increase wealth while holding them as long-term assets. Furthermore, AMSTERDAX also offers the ability to stake, allowing interest to be earned on unused crypto. This allows you to earn even when you are not actively trading.

- World-Class Platform – AMSTERDAX offers a world-class online trading platform that you can access anywhere you have a browser and an Internet connection. The platform is intuitive and easy to navigate. Furthermore, AMSTERDAX offers updates as necessary.

What is CAC 40 in Forex?

The “CAC 40” is the listing of 40 of the biggest companies in France. By trading the CAC 40, you are betting on the overall health and strength of the French economy.

Is the CAC 40 a Good Investment?

It can be. Obviously, it is a great instrument to trade because it is highly liquid, and it is essentially betting on the entire French economy, thereby simplifying the entire investing process.

What’s the best strategy to trade the CAC 40?

The best strategy to trade the CAC 40 will be the same as anywhere else: it will be a mix of fundamental, technical, and trend following. Ultimately, this is a market that is like most other indices, it does tend to trend for very long periods of time.

What are the top five largest companies in CAC 40 in terms of market capitalization?

The top five companies in the CAC 40 include LVMH, Total SA, Sanofi, L’Oréal, and Schneider Electric.

How often do CAC 40 companies change?

Market weighting is calculated quarterly, although companies do not necessarily change that often. It comes down to the calculation of various companies and whether or not they meet the threshold to be included in the index.