Trading the IBEX 35 is a great way to get exposure to the Spanish economy. Spain is a dynamic and major economy in the European Union, and therefore the IBEX 35 has plenty of liquidity for traders to take advantage of. While the DAX and the FTSE 100 are more commonly thought of, the IBEX 35 offers much more volatility.

What is the IBEX 35?

The IBEX 35 is a benchmark of the top 35 companies in Spain, listed at the Bolsa de Madrid. The IBEX 35 has been around since 1992 and is calculated by the Sociedad de Bolsas, which is part of the Bolsas y Mercados Espanoles, which runs the Spanish security markets.

The index is a market capitalization-weighted index, meaning that the largest of the companies have an outsized effect on the index, much like the NASDAQ 100, or the S&P 500. By trading the IBEX 35, you are placing a bet on the overall health of the Spanish economy.

The IBEX 35 Companies

The Spanish IBEX is reviewed in both June and December to determine the eligibility of various companies in the index, and whether they should stay, go, or be warned whether they are close to elimination.

To be included, there are a series of requirements, with the most common one being the highest volume of transactions on the stock exchange. The index requires that the company continues to attract trading action. Remember that the index is market-cap-weighted, so in order to get included, there needs to be a large volume of transactions. Below is a table showing the top ten companies in the IBEX:

| Company: | Weighting %: |

| Iberdola | 15.61 |

| Inditex | 11.63 |

| Santander | 11.19 |

| BBVA | 6.96 |

| Amadeus IT Group | 5.99 |

| Telefonica | 4.98 |

| Celinex Telecom | 3.87 |

| Aena | 3.78 |

| Repsol | 3.73 |

| Ferrovial | 3.44 |

IBEX 35 trading hours

The IBEX 35 is listed on the Madrid exchange, which is open from Monday to Friday. The Bolsa de Madrid is open from 8 AM to 4:35 PM GMT. These are typical trading hours for an exchange, but with the CFD market that we offer at AMSTERDAX, we have the ability to trade outside of those hours as well. Keep in mind that liquidity may not be as strong outside of local business hours.

How Is IBEX 35 Calculated?

The IBEX 35 is calculated like many other popular stock indices. It uses a basket of 35 companies, and the changes in their stock prices to give a price for the index. It is euro-denominated, calculated in real-time during the trading hours of the Madrid Stock Exchange, and is weighted upon market capitalization.

The index is adjusted by a free float factor, meaning that the biggest constituents of the index have a higher percentage of the calculation, while smaller companies have a much smaller impact. Unlike most other major indices, the IBEX 35 has no weighting limit for a company, so therefore you should be aware of the makeup of the index and who the top 10 companies are. You should also check every six months when the index is reevaluated. This allows the trader to keep an eye on the biggest stocks that will be driving this market either higher or lower.

The History of the IBEX 35

As with all indices, the IBEX 35 has a history of ups and downs. The IBEX 35 is not immune to global forces, nor is it immune to domestic pressures either. The following table lists some of the highlights of the market since its inception in early 1992.

| Date | Major Event |

| January 14, 1992 | IBEX 35 is published for the first time. It has a base value of 3,000 points. |

| October 1992 | The IBEX 35 reaches a record low of 1873.58. |

| 2000-2007 | Strong domestic growth pushes long-term uptrend in the IBEX 35. |

| November 2007 | IBEX 35 hits all-time high of 15945.70 |

| 2007-2009 | High volatility proceeds the Great Financial Crisis. |

| March 2009 | The IBEX 35 dips below 7,000. |

| 2010-2011 | The IBEX 35 struggles, in reaction to domestic economic problems, and the Eurozone crisis. |

| June 2012 | IBEX reaches 6,065. |

| 2014-2017 | IBEX 35 climbs over the 10,000 level. |

| 2019 | Along with other indices, the IBEX has a strong year, gaining 11.82%. |

| 2020 | The global pandemic sends the IBEX 35 down over 15%. |

Chart courtesy of Tradingview.com

What Drives the IBEX 35’s price?

While there are literally unlimited reasons for the IBEX 35 to move, there are some relatively common things that influence the value of the index. The markets pay special attention to some of the following headlines and instances, as they can give you insights as to the health of the Spanish economy and the companies on the index itself.

- GDP – All indices that focus on a country are affected by the GDP figures of the country representative. After all, if Gross Domestic Product is rising, that is a sign of a healthy economy, and therefore will be reflected in the companies domiciled there.

- Monetary Policy – Monetary policy has an influence on what happens with stock indices, and the IBEX 35 will be no different. Keep in mind that the most important monetary policies are set by the European Central Bank, and not the Spanish central bank.

- Politics – Politics are especially contentious in Spain at times, and the overall mood of the country and the way it boats can have a major influence on governmental decisions when it comes to business and the economy on the whole.

- Exchange Rate – Exports make up a major part of most economies, and Spain will be no different. If the Euro gets to be too strong, then it can have a detrimental effect on those exports. The exact opposite can also be true as well, as cheap Spanish goods may be attractive to foreigners.

- Corporate Earnings – The IBEX 35 will also be affected by corporate earnings from the major participants, and therefore these announcements should be paid close attention to. If major players in the index are beating analyst estimates, that is generally assigned that the IBEX 35 should continue to gain. If they are missing analyst estimates, then this can have a detrimental effect on the index.

What Are the Benefits of IBEX 35 trading?

Trading the IBEX 35 offers a host of benefits, not the least of which would be simplicity. Trading the Spanish index is a great way to play European growth, as Spain has a large banking sector that is quite active throughout the EU. Furthermore, Spain has one of the more dynamic economies on the continent, and therefore the index itself offers plenty of opportunities.

- Diversification – While the IBEX 35 focuses on one economy, the Spanish index is full of banking, telecommunications, tourism, and consumer staples. By trading the IBEX 35, you get exposure to multiple industries.

- Simplification – By trading the IBEX 35, you are making a bet on one economy, and therefore trading multiple companies without having to read through complicated financial statements. By picking a direction overall, you can trade the market itself.

- Leverage – Trading the IBEX 35 CFD at AMSTERDAX gives you the ability to leverage your position and trade a larger position than would normally be possible. This can increase your profit quite drastically.

- Highly liquid – The Ibex 35 CFD market is highly liquid, so traders have the ability to go in and out of the market quite easily. In fact, all instruments the trade based upon the IBEX 35 are highly liquid as it is a major market in the European Union.

- The ability to hedge existing positions – If you happen to own stocks in Spain, you can use the IBEX 35 to hedge your existing positions.

What Are the Drawbacks of IBEX 35 trading?

Obviously, nothing is perfect. There are some drawbacks to trading in the IBEX 35, as some of the nuances are not as obvious.

- Localized – You need to understand that the IBEX 35 is localized to Spanish companies, meaning that you need to understand what is going on in the Spanish economy.

- Volatility – Volatility can be a great thing, assuming that you capture the move. However, if it works against you then it can be quite dangerous. Because of this, you need to be very cognizant of your position size and recognize that the IBEX 35 moves much quicker than some other indices you may be used to.

- Heavy exposure to financials – Having major exposure to financials can either be positive or negative, depending on the economic cycle. You must be aware of what the global economic cycle is at the moment, to understand whether or not there will be a lot of demand for loans.

- Can be sensitive to Euro – As the IBEX 35 is located in the European Union, you need to pay attention to the Euro and the exchange rate. The large amount of tourism that makes up the IBEX 35 is highly sensitive to foreign exchange levels.

How to trade IBEX 35

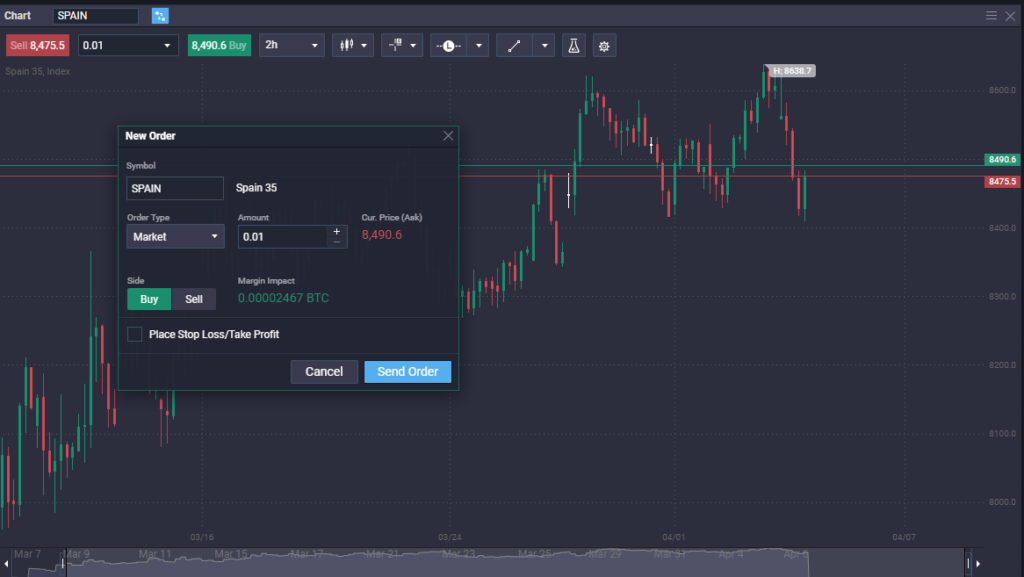

Trading the IBEX 35 can be done through a multitude of instruments, and which one you choose will drastically affect the potential exposure and potential profit and loss of your positions. At AMSTERDAX, we have chosen to offer CFDs.

IBEX CFDs

The CFD market is an abbreviation of “contract for difference.” The contract is a derivative of the underlying index in which the trader enters an agreement to go long or short of the market, without going through the exchange itself, and offers the ability to use leverage. The trader or broker on the other side of the agreement takes the opposite position, with a cash settlement at the close of the trade.

The major benefit of using the CFD market is that liquidity is high, you do not have to go out to the exchange and pay extra fees, and you also have the ability to trade smaller positions instead of a larger standardized contract. CFD markets are perfect for small and large accounts because they are so flexible with position sizing. At the end of the trade, you either gain or lose the difference between the entry and exit price.

IBEX 35 futures

The IBEX 35 is able to be traded via futures, which is a derivative of the index itself. Futures markets are on a regulated exchange and have standardized contract sizes. If you have a large enough account, it does present an opportunity as they are leveraged, but keep in mind that each contract can be expensive, and therefore for most retail traders, the CFD market offers a superior alternative.

One of the most common ways that people take advantage of IBEX 35 futures is hedging and existing or folio. For example, if you hold several Spanish stocks and are worried about a pullback, you may short the IBEX 35 futures contract to protect yourself on the downside.

IBEX 35 stocks and ETFs

If you choose to try to benefit from the IBEX 35, one Route that you can take is to simply buy various stocks on the index. The biggest difficulty is picking the right company and the fact that your risk is extremely concentrated. The buying of single stocks can fall victim to a company-specific problem while trading the entire index helps mitigate some of those risks.

While picking a specific company can lead to outsized gains, the reality is that it takes much more in the way of research to become good at it, something that most retail traders do not have the time to do, nor do they have access to all of the pertinent information easily.

Another thing that we can take advantage of it is an ETF. Exchange Traded Funds are financial instruments that try to mimic the entire sector, index, or even economy by owning bits and pieces of various companies. While ETF trading is a great investment, it does not offer the leverage or the potential gains that they CFD does. Furthermore, fees at your broker can add up.

Tips for IBEX 35 Trading

Trading the IBEX 35 can offer monumental opportunities if approached correctly. The IBEX 35 is a highly liquid and widely followed index, but this does not mean that you jump in with both feet without thinking of the following:

- Backtest – Make sure that any system that you are using backtests quite well against the IBEX 35, as it is a little bit more volatile than some other indices such as the DAX or the S&P 500.

- Position sizing – Position sizing is crucial when it comes to trading any financial instrument, and the IBEX 35 will not be any different. Make sure you keep your position size reasonable.

- Local News – Keep an eye on local news, be it Spanish financial information, or information coming out of the European Central Bank, which has a major influence on monetary policy throughout the continent.

Why Trade IBEX 35 With AMSTERDAX

Trading the IBEX 35 with AMSTERDAX is a great way to get exposure to the Spanish economy, as well as growth in the European Union. The IBEX 35 has a more dynamic volatility profile than many of the other major indices, therefore it tends to offer larger opportunities both long and short.

- CFD market – AMSTERDAX offers the CFD for IBEX 35, meaning that you have the ability to trade in smaller positions if necessary. Furthermore, the CFD market does not force you to trade a standardized contract, meaning that you can trade partial contracts to customize your exposure.

- Leverage – Prime XBT offers 1:100 leverage on the IBEX 35, allowing traders to increase profits with smaller accounts. The growth exponential is something not to be overlooked.

- Crypto deposits – AMSTERDAX accept crypto deposits and offers the ability to use your crypto to increase wealth while holding them as long-term assets. Furthermore, AMSTERDAX also offers the ability to stake, allowing interest to be earned on unused crypto.

- World-Class Platform – AMSTERDAX offers a world-class online trading platform that you can access anywhere you have a browser and an Internet connection. Because of this, trading can be done from anywhere. Furthermore, AMSTERDAX constantly monitors the platform for bugs and applies fixes regularly.

What does IBEX 35 stand for?

IBEX 35 stands for “Iberian index”, with 35 representing the number of companies listed in the index itself. The IBEX 35 is an index that is often used to represent the overall Spanish economy. The 35 stocks that make up the IBEX 35 are the most liquid and heavily traded stocks in Spain.

Is IBEX a good investment?

It can be. It depends on the trajectory of the Spanish economy, and risk appetite overall, but it is a good way to get exposure to one of Europe’s fastest growing economies. The Spanish index offers much more in the way of momentum than some of its larger competitors in the region.

What are the major indices related to the IBEX 35 index?

Indices that are related to the IBEX 35 include the Madrid Stock Exchange General Index, the Valencia Stock Exchange General Index, and the BCN-100 in Barcelona.

What is the exposure of IBEX 35 companies in Catalonia?

The IBEX 35 in general is not overly exposed to Catalonia. In fact, according to research conducted by the Bolsas y Mercados Espanoles, companies on the index derive only about 1/3 of their revenues in the region. That being said, there have been instances of the index selling off drastically due to separatist concerns.